In this article we are going to look at what the terms Bear Market and Bull Market mean, which simply mean bear market and bull market.

Let’s look in detail at what they are and how you can exploit these two scenarios to gain.

- Bear Market

- Bull Market

- How to survive the bearish and thrive in the bullish

- How and what to invest in

- Conclusion

Bear Market

A Bearish market is a ribassist market, that is, one where the peak highs and lows are always declining and is usually associated with a drop of 20 percent or more in the market.

This animal was chosen because when it attacks it does so from the top down, but we can also associate this decrease with the way the bear holds its head while walking.

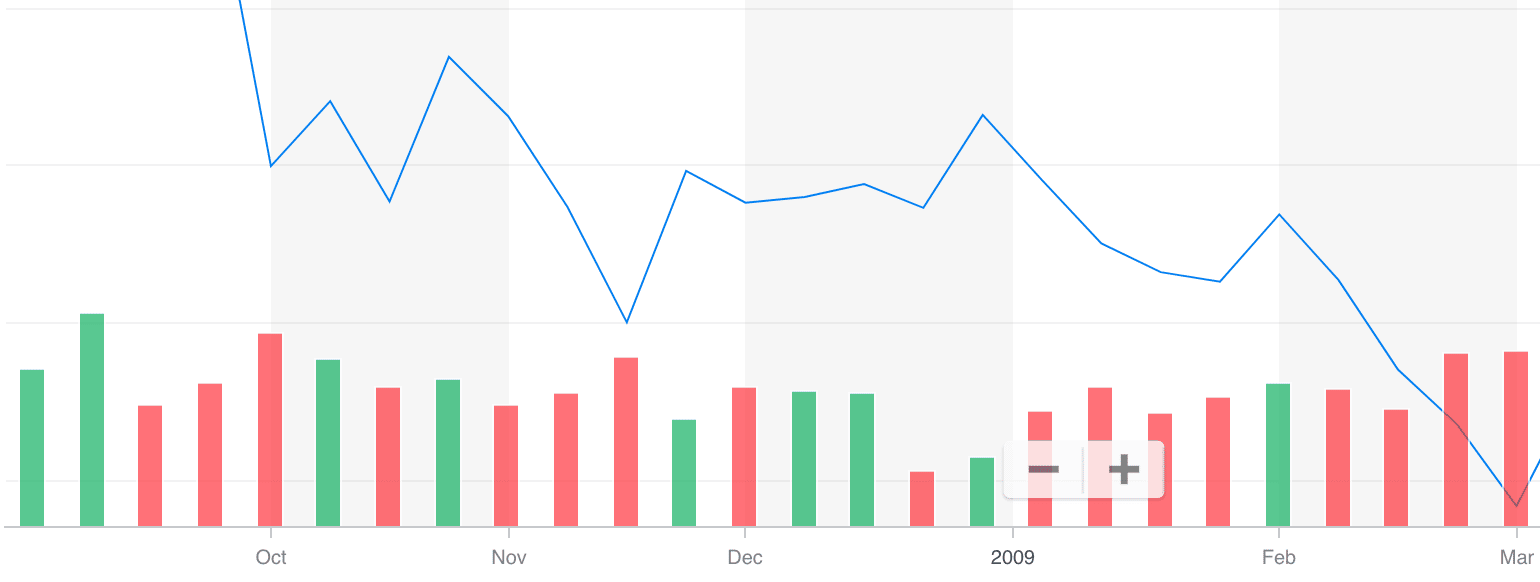

To give an example of the market’s performance at this stage, we can refer to the 2008 crisis where the S&P500 index fell 45 percent in just under a year.

In the graph above, we see the trend fromOctober 2008 to March 2009 where the low was reached and then rose again.

The implications of a bearish market

The drop of more than 20 percent is often the result of a combination of factors, including negative economic data, political or geopolitical uncertainty, or a general loss of investor confidence.

This leads investors to be more pessimistic about the future of the economy and markets, which can lead to a withdrawal of investments and a lower appetite for risk.

During these periods, companies may see a decrease in sales, profitability, and may reduce hiring or even lay off employees.

Finally, with a bear market, companies may find it more difficult to raise capital through the sale of stocks or bonds, limiting their ability to expand or restructure.

The implications are:

- Growing pessimism and loss of confidence among investors

- Possible trigger or mirroring of an economic recession

- Difficulty for companies in raising capital and potential reduction in hiring or increase in layoffs

How to exploit a bearish market

Although a bearish market may seem like a bad time for investors, there are several strategies that can be adopted to protect capital or even profit from such conditions.

The best method to take advantage of this situation is short selling.

In this way we borrow a stock (worth let’s assume $100) to return it at a later time (when the stock is worth, say $70).

The difference of $30 is our gain that we were able to achieve despite the fact that the market was declining.

Of course, this is a simplification dealing only with the positive effects of short selling. This tool should be used by professionals and with caution because it can lead, in the worst cases, to theoretically infinite losses.

During bearish markets, moreover, some assets such as gold, government bonds, or some currencies are considered “safe havens”and tend to maintain or increase in value.

It is also important to have a diversified portfolio that can help reduce risk, as not all assets or sectors react the same way in adverse market conditions.

Investors with a long-term view may see a bearish market as an opportunity to buy quality assets at a discount, anticipating a future recovery.

But even those who make trading can gain great satisfaction from this potentially negative scenario.

The implications are:

- Short selling of securities or indexes to profit from price declines

- Investing in assets considered safe havens

- Maintaining a diversified portfolio to reduce risk

- Opportunistic buying of quality assets in anticipation of future recovery

Bull Market

A Bull market stands for a growth of 20 percent or more of the market.

This animal was chosen since it attacks by goring from the bottom up, and not even saying that it immediately became symbol and icon of growth.

In fact, almost everyone knows that near the New York Stock Exchange (the New York Stock Exchange) for propitiatory purposes there is the famous statue of the charging bull.

The implications of a bullish market

The environment of a bullish market can significantly influence the behavior of both investors and companies.

During a bull market, investors tend to show a greater appetite for risk, believing that investments will realize positive returns.

This confidence can lead to increased investment in stocks and other risky assets.

A bullish market may also reflect or contribute to an economic expansion phase. Companies may see increased sales, profits, and capacity for expansion.

Finally, companies can take advantage of favorable equity markets to raise capital through initial public offerings or equity issues.

The implications then are:

- Increased investor confidence and risk appetite

- Reflection or contribution to a phase of economic expansion

- Opportunities for companies to raise capital under favorable conditions

How to take advantage of a bullish market

Taking advantage of a bullish market means capitalizing on opportunities that emerge during this favorable period.

However, it is essential to do so with a clearly defined strategy and a clear understanding of potential risks.

In a bullish market, investors can seek to diversify their portfolio by including assets that are expected to benefit most from the bullish trend.

Given the positive nature of the market, investors might consider long-term investment opportunities that promise sustained returns over time.

It is critical to re-balance the portfolio regularly, making sure that the distribution of assets remains in line with the investor’s goals and risk tolerance.

Investors can also explore the use of financial instruments such as options and futures to protect their investments or further capitalize on bullish trends.

The implications then are:

- Portfolio diversification to capitalize on the bullish market

- Exploration of long-term investment opportunities

- Regular re-balancing of the portfolio to maintain an ideal distribution of assets

- Use of advanced financial instruments to protect and enhance investments

How to survive bear markets and thrive in bull markets

By now you may be wondering what the magic formula is to be able to always gain without using complex financial instruments or varying strategy as the market changes.

First of all, we must remember that commissions are one of the main costs that erode our earnings.

So you have to limit as much as possible what you have to do, and what I recommend I do (and do) is to buy and keep forever.

Second, since no one can predict market highs and lows, the only tested and effective way to buy at a good price is to buy small quantities of the asset of our interest periodically (once a month, twice a year, etc.).

This way we will take advantage of the Dollar Cost Averaging and on the long term we will have a very good average purchase price.

How and what to invest in

That leaves the last thing to decide, which is what to invest in. As we understood, we have to limit the number of trades and consequently the number of different stocks or funds to buy.

With this strategy we can then take the best of both worlds.

We will not, of course, have stratospheric returns, but our 5 percent per annum (considering an annual growth rate of 5.9 percent over the last 20 years of the S&P 500) over the long term we should take it home comfortably and without any particular fear of losing all the capital.

Conclusion

Both bullish and bearish markets are physiological aspects of the economic and financial cycle.

While bullish markets are often associated with periods of optimism, growth, and opportunity, bearish markets remind us of the importance of prudence, strategy, and the ability to adapt to a changing environment.

The key to successfully navigating both scenarios lies in understanding, preparation and flexibility.

Investing requires a long-term view, a deep awareness of market dynamics, and a willingness to continuously learn and adapt.

I hope I have clarified these two concepts and given you some good food for thought. Let me know in the comments or by email at info@diventeromilionario.it.

FAQ Section

A bull market refers to a market in which financial asset prices are rising or are expected to rise.

A bearish market indicates a market in which financial asset prices are falling or are expected to fall.

The main causes may include negative economic data, geopolitical uncertainty, rising interest rates, and loss of investor confidence.

Yes, investors can profit by selling short, investing in safe haven assets or conveniently buying quality assets at a discount.

Diversification, investment in safe haven assets, and regular re-balancing of the portfolio are effective ways to protect one’s capital in bearish market periods.

Disclaimer

This article is only informational and NOT for professional or educational purposes. The topics covered must not be understood as financial advice.

Do not sell or purchase of the financial securities covered.

You must always think with your own head and act only if you understand what you are doing. If not, better stay still.

In any case, only invest capital that you are willing to lose, because that is what could happen!

The author and the website disclaim all responsibility for any action taken or not taken based on the content of this article.