Do you want to make the most of your money in 2023?

Investing your money is a great way to increase your wealth, but it can also be a complex process, infact you will need a careful consideration and a lot of knowledge.

Remember, the first goal must be not to lose money.c

Thanks to this article, you will be able to start building a realistic and achievable investment plan.

There are many ways to invest our money and they vary based on the capital we have:

- Invest in the bank

- Invest in the stock market (stocks, ETFs, or bonds)

- Invest in real estate

- Buying commodities or safe haven assets

- Buying luxury items

- Buy Bitcoin

Let’s look at them, trying to understand for each of them the level of risk, the necessary skills, and the return.

Invest in the bank

Investing in a bank, through deposit accounts, mutual funds, and other instruments, can be a smart decision.

However, remember there are both advantages and disadvantages to consider before making such an investment.

Returns are usually decent and the associated risks are lower, but you may encounter hidden or unexpected costs.

Needless to say, that’s where the bank makes its profit.

It’s crucial to take the time to study the documentation and the KIID to avoid unpleasant surprises in this regard.

The 4 main types of bank investments are:

- Deposit Account

- Mutual Funds

- Equity Funds

- Bond Funds

Opening a Deposit Account

In a deposit account you can only deposit money for saving purposes and cannot perform other operations.

It’s a tool that every saver has used at least once, rather than putting the money under the mattress.

The rules are very simple, that is, by opening this account, we will have a parking lot for our money.

The deposit account is a must-have as it will contain a potential cushion for emergency expenses.

We can increase the capital present or we can withdraw it immediately in case of need.

Of course, this is if we have not tied up our funds for a predefined period.

Mutual Funds

Mutual funds are instruments managed by dedicated companies that collect sums from multiple savers and invest them.

In this way, you can access more opportunities, increase interest rates, and cut costs.

The risk of this type of investment is low, as they are usually managed by professionals and know how to act.

As we can see from the image below taken from sole24ore, despite the titles have a high rating, the returns in the last year are negative.

The main problem, in addition to the market, concerns costs.

Often these products are full of hidden fees (that’s where the bank earns) and even if the return is good, once the fees are paid, little remains. Let alone if the return is poor.

The level of risk is also due to the composition of the fund. If it is equity-oriented, it will be riskier than a bond one.

They are easy to subscribe to as they are well advertised by banks and the procedure to invest in them is simple.

In this way, by eliminating all frictions, they attract more investors compared to other tools.

Equity Funds

Equity Funds are growth-oriented mutual funds that have a portfolio composition primarily in stocks.

The returns on these instruments are generally higher among all mutual funds, as they have within them titles that historically perform very well (stocks).

However, as the return increases, so do the associated risks. We must have a clear understanding of our financial planning, risk propensity, and diversify the portfolio.

Bond Funds

Bond Funds are very conservative mutual funds with a low level of risk, which have a portfolio composition primarily in bonds.

If we want to sleep soundly and don’t mind seeing red on our portfolio even when the market is doing well, bond funds are the right choice.

The risk is low, but the real question is: will the return cover the costs? Or are we investing at a loss?

Unfortunately, there are many limitations to this particular instrument.

They can be sold easily, as bonds have always been synonymous with stability (which is actually not true), but we must be careful to have the costs explained to us in detail, otherwise we could have some unpleasant surprises.

Invest in the stock market (stocks, ETFs, or bonds)

Investing in the stock market means using a broker to independently purchase shares or financial instruments of interest to us.

There are many investment opportunities when you enter this world (CFDs, options, certificates etc.).

I will only cover the main ones as they are less complex and there is less risk of losing capital.

The instruments that can be used to invest in the stock market are:

- stocks

- bonds

- government securities

- ETFs

Stocks

A share is a small part of a stake in a company. By buying one or more, we will become owners of a portion of the company in question.

To be able to invest in stocks, we need to have a proper understanding of the various platforms that offer this service, the commissions and taxation.

Investing in stocks is the most famous method with which people have created financial well-being in their lives (like Warren Buffett).

The risks

The risk of these investments is high.

We can lose all our capital in case of company failure, but on the flip side, we can earn year after year if the company is thriving and continues to grow.

Clearly, diversification and financial planning are mandatory, as we cannot afford to put all our eggs in one basket.

We can think of buying different companies in the same sector (Coca Cola and Pepsi) and also of different sectors (Caterpillar for construction and Abbvie for pharmaceuticals).

In this way, we try to buffer the volatility of the market by betting on the fact that if one goes down the other goes up.

There are many methods to find worthy companies to be analyzed and owned. One of these is to take a look at Blue Chip Stocks, famous, capitalized, and industry-leading companies.

Dividends

Dividends are periodic payments (annual, semi-annual, quarterly, or monthly) that the company makes by sharing profits with all shareholders.

Not all companies pay them, so you have to choose them carefully.

By structuring our portfolio well, we can have a positive cash flow without ever having to sell our shares.

These investments will continue to gain value in the long term and in the meantime generate an income.

Below you can see an example of what I mean, taken directly from my trading account.

Some famous stocks (e.g. Amazon) do not pay dividends.

So to monetize them we will have to sell them.

Usually companies that are growing rapidly, reinvest all profits instead of paying them to shareholders.

In this way they have more capital to use and can achieve their goals more easily.

Bonds

Bonds are a loan we make to a company or entity that will be repaid to us after a set period of time at a known interest rate.

When we buy a bond, therefore, we will already know the maturity and yield.

This causes there to be a false sense of peace of mind when investing.

If I already get the returns, it means that I will certainly get them.

We need to abandon this thinking, as risk is always hidden behind every financial instrument.

We can never reset it, we can only limit it with expedients knowing that if the worst happens we will still be covered.

Think of bonds yielding 10 percent in two years issued by an unknown company or one belonging to a very volatile sector such as cryptocurrency.

In this case we must be clear in our minds that if the company fails, and often bankruptcies come when it is time to repay the bonds but lack cash, we will have lost all the capital invested.

The advice is to rely on solid companies that have a solid financial history behind them and are in good health.

Why borrow with bonds

We should not think that if a company borrows through bonds it is going to fail.

On the contrary, large corporations have realized that using debt to grow and in turn make investments is one of the “tricks” that works best.

Apple does not have a liquidity problem, but issues bonds periodically in order to invest and grow further.

The interest rate, in this case, varies but is around 3 percent.

Bonds, just like stocks and all major financial instruments, can be traded in the market through our preferred broker platform.

Clearly, the more the title is sought after, the more liquid it will be. That is, we will be able to sell it in an easy way.

On the other hand, if we are in possession of an unknown bond, we may not find interested buyers and consequently wait or sell it off at a price far below the market.

Coupons and zero coupons

Bonds can pay periodic returns through so-called cedules. We will thus find ourselves cashing out year after year until maturity, when we get our principal back or until we resell them.

There are also bonds called zero coupon bonds that do not take off any coupons and therefore do not give payments until maturity.

In this case we will only monetize investments at maturity.

State title

Government Bonds are bonds issued by the Italian state through the Treasury Department, and the funds raised are used to finance the investments the country will need to sustain.

They can, of course, be issued by any existing country.

Bonds issued by nations are a good way to invest money knowing that the guarantee is put up by the whole country.

To lose all capital means that a nation has to go into bankruptcy and this thing is very rare.

One of the most famous examples is the Argentine Bonds, which proved to be a failed investment during the 1990s.

They were traveling at a 10 percent rate that has turned out to be unsustainable and many investors got really hurt by being left with nothing.

Opposite case, German bonds (called BUND) in 2021 were considered so safe that they had achieved a negative yield of 0.06 percent. That meant that at expiration I was going to get back less capital than I had deposited.

Government bonds – Why lend money to your country?

Understanding whether it makes sense to lend money to Italy by buying government bonds is an interesting thought.

This reasoning can be made in two diametrically opposed modes of thinking.

In fact, we could say:

- it is right to invest

- is too dangerous

It is right to invest

If we are in this country, it means that we believe in it and want to see it get better and better. Consequently, we don’t expect things to degenerate at all and are quite happy to lend money through government bonds.

That way investments will be made that will benefit me as well.

It is too dangerous

Looking at it from the other side, diversification is crucial. So in the case of a failure of Italy I would go and lose all my investments and I would be in a really uncomfortable and ignored situation.

ETF

Exchange-traded funds (ETFs) are financial instruments that collect within them a basket of securities to replicate a precise index.

For example, an ETF on the S&P500 will contain all 500 companies within it.

Taking advantage of this passive management methodology, Exchange Traded Funds (ETFs) have very low costs (as low as 0.07 percent annual cost).

The diversification is high because depending on the stock we choose we can count on a number of companies from a variety of sectors and countries, making it very stable and not very volatile.

The most we can think of is given by a ETF world, for example Vanguard’s FTSE All World.

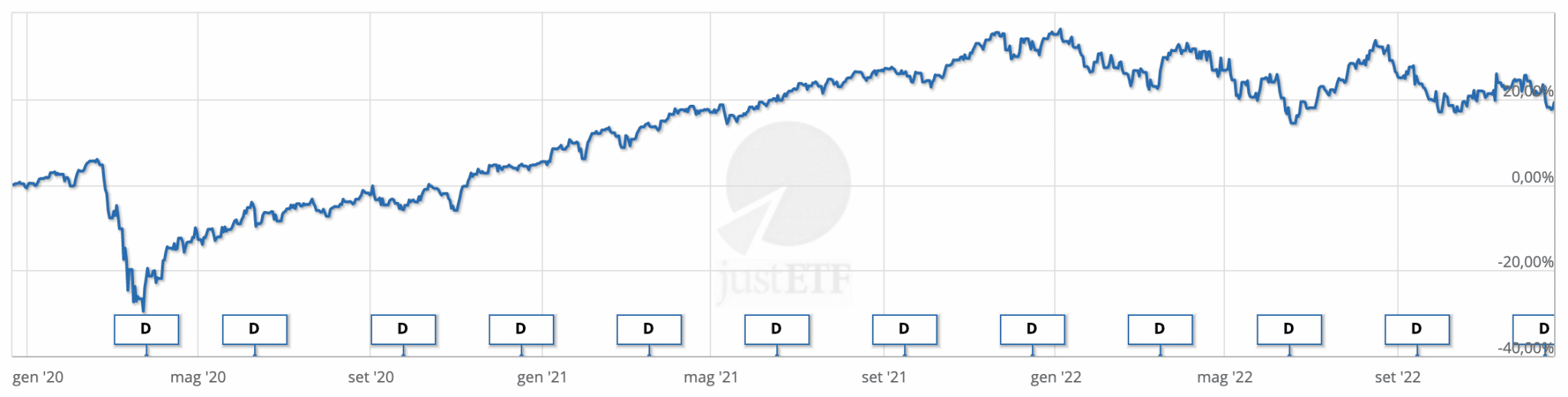

As we can see from its trend in the graph below (source JustETF) it has responded well to the various crises while maintaining a reduced volatility.

ETF does not mean diversification

At this point we might be inclined to think that ETFs are the solution to all problems and that whatever we buy we still fall on our feet.

The reality is different, because if we invest in a stock that tracks the performance of a single sector (perhaps even a very volatile one) we risk finding ourselves with heavy losses.

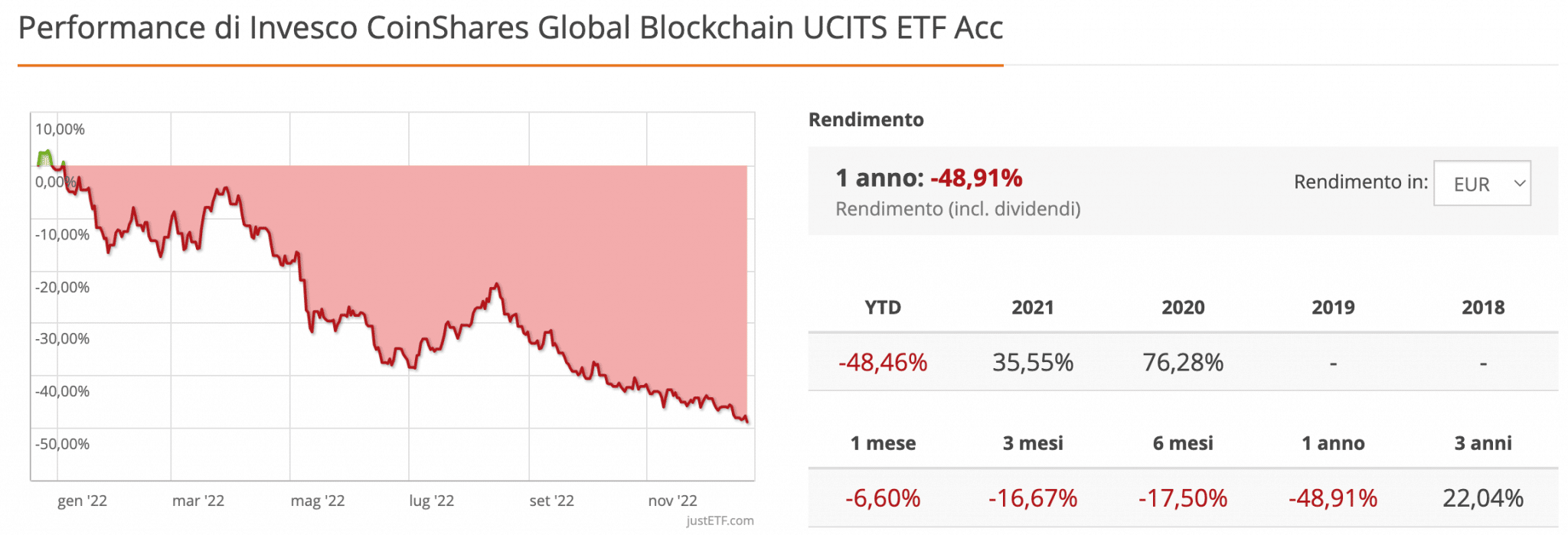

Taking the blockchain sector as an example, we see how the performance of the stock “Invesco CoinShares Global Blockchain UCITS ETF” is in heavy loss since the beginning of the year and has recorded a -48.91% (source JustETF).

By comparison, the “world” ETF seen above has lost only 11.78 percent in the past year and while it has also paid dividends, this one has not.

Dividends

Exactly as with stocks, ETFs also pay dividends. After all, these instruments may be stock containers, so it is obvious that cash flow is passed on to those who hold them.

When selecting, we will have to pay attention to “Distributing” and “Accumulating,” which differentiate those who pay and those who keep money inside.

Invest in real estate

Investing in real estate involves buying and selling houses or apartments, or putting them to income through rentals.

It is an increasingly popular way to diversify one’s portfolio with safe investments (always remembering that security in this world does not exist).

While there are advantages, such as the ability to earn a steady return on one’s investment, there are some significant disadvantages that need to be considered before investing.

The need for a lot of money and the probable appearance of contingencies during the various operations are some of the issues we are going to encounter.

Nevertheless, ways of investing in brick (i.e., real estate) have appeared that seek to break down these limits by making access free to all.

Let’s look at the features of each of these options to see which one may be right for you.

Ultimately, remember that finding the right balance between risk and reward is essential when deciding how to invest in real estate.

The types of investments in real estate are:

- Crowdfunding real estate

- House flipping

- Short rentals

- Buy shares in REIT companies

Crowdfunding real estate

Real estate crowdfunding involves raising funds from many investors through a platform that will then go on to invest this capital in the chosen projects, offering a predetermined return.

This type of investment allows us to receive returns on our capital without having to move from home to view houses or request documents from the municipality.

All it takes is an Internet connection and a transfer to replenish the account and we are ready to operate.

In fact, with the platforms present today, investing in real estate crowdfunding takes little time and you have a wide choice of projects and sites to use.

To minimize the risk I recommend diversifying as much as possible, not depositing all the money in one company but also opening 3-4 different accounts.

The level of risk is high because we have no control over the progress of the project or the financial health and how the company handles the money.

Should it fail, we may all lose our invested capital.

On the other hand, the return on these investments is really attractive, which may prompt us to look into this activity to see if it may be right for us.

Best Real Estate Crowdfunding Platforms

To invest in this sector, one must first rely on companies that have been in operation for years and have a reliable payment history.

The 3 most popular platforms in this area are:

- Housers

- Urbanitae

- Truster

House Flipping

House Flipping refers to the purchase of a property at a discount through bankruptcy auction or other means.

A very fast real estate sale (few months, max one year) that exploits the solvency issues of the owner to extract a favorable price.

The yield is very high since the properties that are going to be purchased are underpriced, even in a major way.

In this case even simply renovating the house we can go and have a good revenue.

The difficulty lies in the fact that because it is such an interesting methodology, competition is increasing all the time.

The end result will be that we will have real estate, so for certain we will own something tangible.

This goes to lower the risk and will prevent us, at the very least, from losing all of our invested capital.

The risks of real estate flipping

The risk comes mainly from two situations:

- faulty planning

- contingencies

Incorrect planning

Experience plays a fundamental role, in understanding how to behave during auctions or various proceedings and learning to analyze the things that really matter in making the decision.

If we estimate a profit margin of 20,000$, but then expenses arise, that could be a problem.

Something that could have been foreseen but did not consider (notary, repairs, etc.) amounting to 22,000$.

You understand very well that we will be at a loss unless we completely revise the business plan.

Contingencies

I have talked to many people, and average 90% of real estate transactions of this type have problems.

This statistic can’t be found anywhere except by talking to people who do these activities on a daily basis, and I am very happy to provide it to you.

They can range from leaky pipes to problems with documents from the municipality to tenants who do not want to leave.

It is impossible to predict every case, so the advice I can give you is to budget a percentage dedicated to these situations.

Then start surrounding yourself with skilled and trained professionals who can help you solve them quickly and profitably.

Look for items that increase in value

Investment can also go outside the canons we are used to hearing. A good deal that guarantees us a return on our capital can also be found in any store.

In this case, the returns can be high and the degree of risk lower than normal. We will be the ones, with our continuous study and training to become such experts in the field that we will evaluate on the fly any investment that comes our way.

Clearly, it cannot address all areas, as there are specific items that increase in value over time.

The most important ones that I have been dealing with and that have given me results are the Pokemon cards

Pokemon Cards

Investing in Pokemon cards means studying the market and buying cards, packs or complete sets aiming for their future revaluation.

The risk of this type of business is very low, as one can start trading with just a few tens of euros, enough to buy a few packages and begin to enter this world.

Once we study and understand market trends, we will be better and better at figuring out what to invest in and what to leave on store or newsstand shelves.

Then using tools such as eBay we can go and make trades of the assets in which we have invested to make a profit.

The beauty of this type of investment is that they are small objects, they are not overpriced (the rarest collections go up to $ 200), they can be found everywhere, and they are globally recognized.

So we can store them anywhere without too much worry, not like a LEGO set that takes up a lot of space.

How I am investing

The last trend is to give more value to items sealed (sealed), then kept exactly as they were when they were in the store.

And this is very nice because it saves us from having to open them, catalog them and hope to find rare and valuable papers.

I myself am investing in Pokemon cards by buying packs that I keep in a box near my desk.

I consider them an investment in that in 10 or 20 years, when I go to open it, I will have something rare and sought-after in my hands.

I just have to be careful to buy them in perfect condition, then time will be my best ally.

Obviously some collections are more prized than others, but going to shoot in the heap buying them all diversifies and reduces the risk.

In any case rarely do you see a package that keeps the same price 3 years after release, so I consider it a wise move.

Although past returns are no guarantee of future ones, and it is not known how “The Pokemon Company” will move forward and how long the fame of these little monsters will last.

Buying commodities or safe haven assets

Shelter and commodities are financial instruments or physical assets that are very attractive to investors’ eyes when there is an unstable or bearish market phase.

They are products that keep their value fairly stable and allow the portfolio to breathe when all the rest of the investments were in the red.

The main ones we are going to cover in this article are:

- gold

- rare earths

Gold

Investing in gold means either physically buying the precious material or buying stocks of companies that deal in it and betting on an increase in its value.

Gold’s yield is relatively low but it is stable, which is enough to make it one of the most attractive assets on the market.

The low volatility and really low risk make it an instrument that can give satisfaction to experienced investors but may turn off younger ones.

Difatti non vedranno mai dei rendimenti o dei movimenti apprezzabili se non nel lungo periodo.

It is really very easy to buy it and invest in this precious metal, as we can buy it:

- physically

- financially

Physically

Buying bars, gold coins or jewelry is the classic method people use to own this asset in their portfolio.

Storage of these investments storage is not a problem as many companies offer the storage service, with the obvious safeguards involved.

We can start from one gram, costing about $70 up to the actual ingot (the one in the films) of 12.5kg and about $700,000 in value.

Financially

Buying gold on paper can take place through shares of companies that have gold mines or process it, or of ETF which track market trends.

This way we will not even have to worry about storage or theft, as we will see it on our trusted broker’s online wallet.

Rare Earth

Investing in rare earths means buying stocks of companies that deal in these periodic elements aiming for growth in the coming years.

Rare earths are 17 elements of the periodic table that are fundamental to the construction of chips and various components used in smartphones, automobiles, computers, etc.

Despite the name, these are very widespread on the planet but are very difficult to extract. In fact, this operation is labor-intensive and often has a devastating impact on the surrounding environment.

The value of these investments could increase greatly in the future precisely because of this scarcity and the continued increase in demand.

Clearly you cannot buy them physically, but only financially through shares in companies that mine or process them and ETFs that track their value.

The rare earths are one of the market’s biggest bets for the future, which could give a big boost to the recycling sector.

In fact, these are widespread in waste, and their recovery would greatly facilitate increased supply.

Buying luxury items

Investing in luxury items means buying goods that have a high cost but are of objective or subjective value.

These luxury purchases can be an exciting and rewarding experience, but it is important to carefully consider whether it is really a wise choice.

The two most famous luxury items are:

- diamonds

- watches

Diamonds

Investing in diamonds corresponds to buying them physically or financially in order to appreciate an increase in their value that guarantees us a gain when we sell them.

Diamonds are a well-known asset class, although the value trend is quite disappointing.

In fact, the returns related to this type of product are low, when compared to the risk.

We can lose them, be scammed and much more, in exchange for paltry profit and high resale difficulty.

Investing in diamonds requires large amounts of capital, in-depth knowledge, and the ability to do the buying, selling, and storing of diamonds.

One of the great advantages of this product is the emotionality it carries with it as a retage of luxury and royalty.

Therefore owning them can make us feel wealthy, even if in reality the returns are not as good as we may think.

Watches

Investing money in clocks starts from selecting one or more products that are already rare or that we estimate will become so, to buying them, storing them, and reselling them when the value increases.

Rolex, Patek Philippe and Audemars are among the most famous brands in this field. The real difficulty in getting started in investing in luxury watches is definitely, in addition to selecting the correct product, the real possibility of proceeding with the transaction.

In fact by choice none of the manufacturers are planning to increase the run of their watches, but the market is always growing.

Doing so creates very long waiting lists and being able to buy it directly from the retailer becomes utopia.

Already we have to go to incur a premium by going through the secondary market, which will lower the possible gains right away.

That is why it may make sense to go down an alternative road, namely studying smaller competitors to see if any of their flagship products can explode and become famous.

Certainly high capital is required to invest, even more than $10,000, and maniacal care in preservation.

Also, even if not in use, they need to be properly serviced. I can already tell you that this will not be cheap and will cost more than a car service.

Finally wearing them means running the risk of winning them, so we won’t even be able to carry them around with us and display them as status symbols.

Buy Bitcoin

Buying Bitcoin to invest money means buying this cryptocurrency hoping that its value will increase over time.

Let’s face it, the times when cryptocurrencies, especially Bitcoin, were doing x1000 are over.

Now that the bubble is beginning to shrink and all the baseless projects that were scams are disappearing, only the winners remain.

And Bitcoin has always been one of them.

The market is very young, so volatility is high. But it is slowly decreasing more and more, for better or worse.

That is, we will see fewer collapses, but also less sudden rises, which this cryptocurrency had accustomed us to and which had enticed many people.

Soon everyone will realize that Bitcoin is a bet on the future of the monetary and financial system and not just an investment to be leveraged for online trading.

The return on investment in Bitcoin can still be high, and some say it will reach a million euros within a few years.

The point is made that it could become a currency used worldwide for trade.

I would like to emphasize again that secure investments do not exist, least of all in the area of cryptocurrencies.

The risks are that:

- Is supplanted by some other coin

- Governments get in the way by hindering its possession and use

The options that allow us to buy Bitcoin are indeed many, so entering this world even with minimal capital and little knowledge is possible.

In addition to the possibility of its value going to zero for the reasons seen above, we also have the risk of losing the principal if the exchange with which we deposited them fails or if we lose the access keys to our wallet.

Concluding on how to invest money

There are many ways to earn money by investing. Some are well-known, while others might surprise you.

All have the potential to get you a good return on your investment, if done correctly.

The most important thing to remember is that there’s no such thing as a safe investment.

You always have to evaluate the risk, become aware of its existence, and act to minimize it while keeping the gain unchanged.

Remember, there is no guaranteed path to success when it comes to investments, but with discipline and a touch of luck, anything is possible.

What do you think about this very long but interestingly informative article? Were you already familiar with all the methods or did any of them surprise you? Would you add something?

Let me know in the comments or via email at info@diventeromilionario.it.

Disclaimer

This article is only informational and NOT for professional or educational purposes. The topics covered must not be understood as financial advice.

Do not sell or purchase of the financial securities covered.

You must always think with your own head and act only if you understand what you are doing. If not, better stay still.

In any case, only invest capital that you are willing to lose, because that is what could happen!

The author and the website disclaim all responsibility for any action taken or not taken based on the content of this article.