Warren Buffett is known worldwide for being one of the richest people on the face of the earth.

Every day, thousands of ambitious people are fascinated by its history: its travel to wealth has not been an uphill sprint, but a gradual ascent.

Therefore, his ideology is an inspiration to many today.

- Who is Warren Buffett

- Biography

- Net worth

- The investment strategy

- Major acquisitions and investment successes

- Personal finance lessons from Warren Buffett

- Quotes

- Conclusion

Who is Warren Buffett

Warren Buffett, known as the Oracle of Omaha, is one of the most respected and successful investors of the 20th and 21st centuries.

Born on August 30, 1930, he began his career in the investment world at a young age and, thanks to his extraordinary ability to understand and evaluate companies, managed to build one of the world’s greatest fortunes.

Born and raised in Omaha, Nebraska, Buffett showed an interest in business from a young age. He bought his first stock at age 11 and started small businesses during his teens.

However, his real training began with the teachings of Benjamin Graham at Columbia Business School.

Graham, often called the “father of value investing,” has influenced deeply Buffett’s investment philosophy.

The key to Buffett’s success can be attributed to his control and leadership of Berkshire Hathaway.

Originally a textile company, Buffett took control and turned it into a multibillion-dollar conglomerate, investing in quality companies with long-term competitive advantages, such as Coca Cola.

The investment philosophy

Central to Buffett’s philosophy is the idea of intrinsic value.

He believes in buying companies well below their true value and holding these shares for a long period of time.

It also places special emphasis on understanding the companies it invests in, making decisions based on sound fundamental analysis rather than market trends.

Simply put, Warren Buffett is a pillar in the investment world, known for his wisdom, his ethics, and his extraordinary ability to generate long-term returns for his shareholders.

Biography of Warren Buffett

Warren Edward Buffett is a legendary figure in the world of finance and investment.

But before he became the oracle of Omaha, he was simply a guy with a passion for numbers and a business acumen.

His story is a testament to the power of education, determination and a sound investment philosophy.

At only 6 years old, Buffett bought six packs of Coca-Cola from his grandfather’s grocery store for 25 cents and resold each of the bottles, pocketing a profit of 5 cents.

The question we may ask is, “How come you decided to buy and resell Coke and not other beverages?”

In a manner as simple as it was cunning, little Warren looked at what beverage the caps he found on the ground around.

The Coke ones were the vast majority, consequently he understood what was most frequently drunk.

After graduating from University of Nebraska, Buffett enrolled at Columbia Business School.

Here, he crossed paths with Benjamin Graham, who became one of his main influences. Graham, author of the famous book “The Intelligent Investor,” taught Buffett the importance of valuing companies based on their intrinsic value and not on market fluctuations.

Berkshire Hathaway

After completing his studies, Buffett worked for Benjamin Graham before returning to Omaha, where he founded the Buffett Partnership Ltd. In 1965, he took control of Berkshire Hathaway, turning what was a struggling textile company into one of the world’s most powerful and respected investment conglomerates.

Warren Buffett’s wealth

Warren Buffett’s net worth, in 2023, is $117 billion (source Forbes).

At the age of 21 years it was $ 20,000.

We could summarize the growth of his wealth in this way:

- At age 26, his net worth was $140,000, the result of an investment partnership, founded with friends and family;

- The first million comes at 30 years, thanks to the partnership’s growth to $17 million in value (of which Warren Buffett’s share was $1.8 million);

- At 40, he reaches $100 million;

- At age 50 he became a billionaire thanks to the U.S. holding company Berkshire Hathaway.

Modesty and a quiet life caused Forbes to take some time to notice Warren and add him to the list of the richest Americans, but when it finally did in 1985, he was already a billionaire.

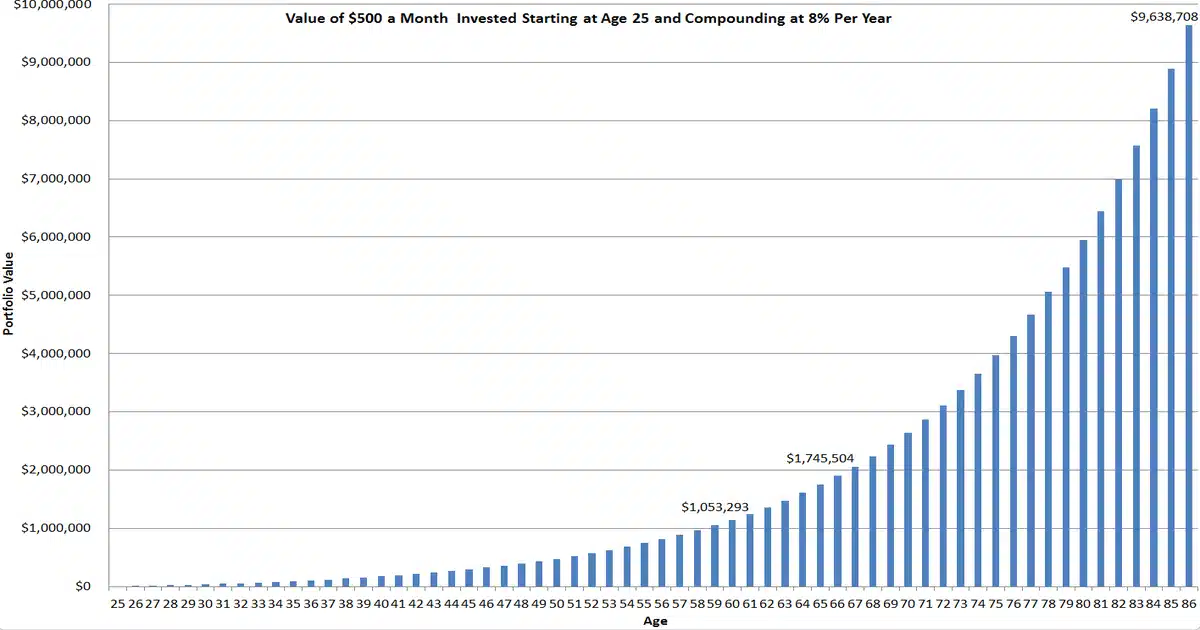

Below we can appreciate the growth of an investment in the long run due to the magic of compound interest.

Warren Buffett’s investment strategy

Warren Buffett’s investment strategy has become the cornerstone for many investors over the years.

Based on sound principles and a forward-looking approach, this strategy has enabled Buffett to achieve extraordinary returns over the years.

The pillars of Buffett’s strategy are:

- Value investing

- Competitive pits

- Long-term

- Understanding of the company

- Sound financial structure

- Competent management

- Price

Value Investing

The heart of Buffett’s strategy is value investing.

This approach focuses on buying stocks of companies that are undervalued relative to their intrinsic value.

In other words, look for companies that are selling out but only because of temporary market conditions.

Competitive Pits

Buffett places great importance on companies with competitive pits.

These are unique and sustainable advantages that protect a company from competition, such as a strong brand or a monopoly in a particular industry.

Long-term

One of the distinguishing features of Buffett’s approach is its long-term time horizon.

While many investors seek quick gains with different types of trading, Buffett is known to hold stocks for decades.

Believes in the power of composition and sustainable growth over time.

Understanding of the company

Before investing, Buffett makes sure he deeply understands the company by avoiding sectors or companies he does not fully understand, regardless of the popularity of the moment.

It also often has a tendency to take over such large shares that it can mput trusted people on the board of directors, who can then guide the company in the best way possible.

Sound financial structure

Buffett looks for companies with a sound financial structure.

Likes companies with little debt, predictable cash flows, and a history of high returns on investment.

Competent management

Leadership is critical.

Buffett invests in companies with competent management that have demonstrated integrity and capability in the past. Otherwise, as already seen, he may decide to put in trusted staff.

Price

Even if a company meets all the above criteria, Buffett will only invest if the price is right.

Look for investment opportunities when the market undervalues a company for various reasons, such as short-term fears or uncertainties.

In summary, Warren Buffett’s investment strategy is based on sound fundamentals, a deep understanding of the companies in which he invests and a long-term view.

This combination has made his strategy one of the most respected and imitated in the investment world.

Major acquisitions and investment successes

Over the course of his illustrious career, Warren Buffett has made a series of acquisitions and investments that have not only increased the value of Berkshire Hathaway, but also solidified his reputation as one of the wisest investors in history.

Here are some of its most successful acquisitions and investments:

- Geico

- See’s Candies

- Coca-Cola

- BNSF

- Apple

- Bank Of America

GEICO

In 1951, after a meeting with Lorimer Davidson, a GEICO executive, Buffett decided to invest a large part of his savings in this insurance company.

Decades later, in 1996, Berkshire Hathaway purchased the entire company, making it one of its main sources of income.

See’s Candies

In 1972, Buffett purchased See’s Candies for $25 million.

The company has consistently provided Berkshire with significant cash flow, demonstrating the value of companies with strong brands and competitive pits.

Coca-Cola

In 1988, Buffett began buying shares in Coca-Cola, eventually owning 9 percent of the company.

This investment proved incredibly profitable and demonstrated the wisdom of investing in global and timeless brands.

Burlington Northern Santa Fe (BNSF)

In 2010, Berkshire Hathaway acquired BNSF, one of the largest railroads in North America, for $34 billion.

This acquisition further diversified Berkshire’s interests and provided a stable income stream.

Apple

Although initially reluctant to invest in technology, Buffett began buying Apple shares in 2016.

Quickly, Apple became one of Berkshire’s major holdings, bringing significant returns.

Bank of America

During the financial crisis of 2008, Buffett invested $5 billion in Bank of America, once again demonstrating his ability to see long-term value even in times of market uncertainty.

Personal finance lessons from Warren Buffett

Warren Buffett, besides being an investment genius, is also an inexhaustible source of wisdom on money management and personal finance.

Here are some of the most valuable lessons we can learn from him:

- Save before you spend

- Avoid unnecessary debt

- Understanding is the key

- Patience and long-term

- The risk comes from ignorance

- Maintain a frugal lifestyle

- Build an emergency fund

- Invest in yourself

Save before you spend

Instead of spending one’s salary and saving what remains, Buffett suggests saving first and spending what remains.

This simple reversal can make a big difference in the way we manage our finances.

Avoid unnecessary debt

Buffett is famous for his aversion to debt. Although he is not completely against the use of debt, he stresses the importance of using it wisely and avoiding unnecessary debt.

Understanding is the key

Before investing in anything, whether a stock or an asset, it is fundamental to fully understand what you are putting your money into.

If you do not understand, it is better to refrain (just as I always say!).

Patience and long-term

Patience is a virtue when it comes to personal finance.

The best investments are often those that are held for the long term, allowing the power of composition to work in one’s favor.

The risk comes from ignorance

One of Buffett’s favorite aphorisms.

Ignorance and lack of research can lead to risky financial decisions. Getting informed and educated is the key to minimizing risk.

Maintain a frugal lifestyle

Despite his immense wealth, Buffett is known for his simple lifestyle.

This teaches us the importance of living below one’s means and not allowing the lifestyle to inflate as income increases.

Build an emergency fund

Buffett emphasizes the importance of having a financial safety net.

An emergency fund can help you navigate through difficult financial times without having to go into debt.

Invest in yourself

Perhaps the most valuable lesson of all.

Buffett strongly believes in investing in oneself, whether through education, reading or acquiring new skills.

This can offer returns that exceed any financial investment.

Warren Buffett’s quotes

A great many of us, including me and probably you, dream of becoming millionaires (or better yet, billionaires).

What his story teaches us is definitely not a magic formula or some illegal ploy, but something much more powerful: hard work, patience and perseverance, always reward. Even (and especially) in business.

Here is a collection of some of Warren Buffett’s phrases from which to start taking cues to become a better investor:

“Be fearful when others are greedy. And be greedy when others are fearful.”.

“The most important quality of an investor is temperament, not intellect. You need temperament not to take great pleasure either in following the crowd or in going against the grain.”

“Successful investing takes time, discipline and patience. No matter how much talent or effort you put in, some things take time. You can’t make a baby in a month by getting nine women pregnant.” .

“You have to do only a few good things in life and for a long time so you won’t do too many wrong things.”

“It is not necessary to do extraordinary things in order to have extraordinary results.”

Conclusion

Warren Buffett, the Oracle of Omaha, is much more than an investment legend.

His wisdom and principles, forged from decades of experience in the world of finance, are a compass for anyone who aspires to solid asset management.

From respecting money, to the importance of patience, to believing in continued investment in ourselves, Buffett’s lessons are universal.

While market trends may change and economies may fluctuate, the fundamentals of wise and informed financial management remain constant.

And as we discovered in exploring Buffett’s life and career, by following these principles, we can all aspire to greater security, prosperity and financial wisdom in our daily lives.

Did you know all these things, or do you want to add more? Let me know in the comments or by email at info@diventeromilionario.it.

FAQ Section

He is one of the world’s richest and most respected investors, often called the “Oracle of Omaha.”

Warren Buffett became a billionaire in 1986 at the age of 56.

He prefers to buy shares in high-quality companies at reasonable prices and hold them for the long term.

No, it makes a variety of investments including real estate and bonds.

Disclaimer

This article is only informational and NOT for professional or educational purposes. The topics covered must not be understood as financial advice.

Do not sell or purchase of the financial securities covered.

You must always think with your own head and act only if you understand what you are doing. If not, better stay still.

In any case, only invest capital that you are willing to lose, because that is what could happen!

The author and the website disclaim all responsibility for any action taken or not taken based on the content of this article.